Marce and I tend to be pretty good at planning our purchases and avoiding “impulse buys”, and I realized that what we’ve developed over the years is sort of an informal decision-making process that helps us determine whether or not it’s time to lay down some cash for an item, and I thought I’d share it here with you.

Marce and I tend to be pretty good at planning our purchases and avoiding “impulse buys”, and I realized that what we’ve developed over the years is sort of an informal decision-making process that helps us determine whether or not it’s time to lay down some cash for an item, and I thought I’d share it here with you.

Essentially, what we have is a 2-part process. First, we determine whether it’s a Need or a Want; then, we determine the best method of getting whatever it is we need or want to buy.

Part 1: Need or Want

The very first question we ask ourselves: “Is this purchase necessary to *maintain* our quality of life?” If the answer to that is “yes,” then the purchase falls into the Need category; otherwise, it’s a Want.

Some examples include:

- Brakes on our car

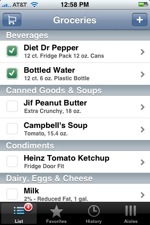

- Groceries

- Replacing worn out shoes

- Dental cleanings

Needs are, as you’d expect, immediately prioritized over any Wants. If it’s a big ticket purchase and we need to save up for it, that one item becomes the focus of our attention and savings. Until that Need is satisfied, our Wants are put on hold (with some exceptions).

Part 2: What to do with Wants

Okay, so what if there’s a purchase that is not required to maintain our quality of life? How do we determine if/how we should buy it?

Well, we ask ourselves a series of questions, as follows:

- Will this purchase fundamentally *improve* our quality of life?

- Will this purchase save or make us money?

- Do we really need to own this item (or can we borrow it from or share it with someone else)?

If the answer to any/all of those questions is “yes,” then it usually passes the “impulse buy” test, and we go through our pre-purchase planning process.

Once we’ve decided that something is worth buying, but not necessarily a Need, we take the following steps:

- Add the item to our Want list (I like to add it to my Amazon.com Save for Later shopping cart list)

- Research online to find out if the item has good reviews or if there is a better alternative

- Compare prices (PriceGrabber.com is a great general reference, but we also check local stores)

- Find coupons or discounts (FatWallet.com is great for this!)

- Save up for the purchase, sometimes for months or years in the case of high price items (In those cases, we re-evaluate the alternatives since in the time we’ve been saving, something better than our original Want may be out there.)

As you can see, this informal process can sometimes take days, weeks, months, or even years, but using this method, we’ve been able to consistently have all of our Needs met, continued to improve our quality of life, and purchased some pretty neat Wants over the years (all while avoiding consumer debt).

To be clear, this is not a strict procedure, but more like general guidelines and considerations. We’ve also applied this method to purchases other than products/items, such as whether or not to take a trip, so the system is fairly adaptable to different situations.

I’d love to hear if you have any ways to filter your Needs and Wants in the comments below!